Solana Beach comes to Wiami

Introduction

Solana Beach has officially arrived in Wiami, bringing the heat of the Solana ecosystem to our sun-soaked shores. This marks a bold new chapter in Wilder World as we expand crosschain, forging deeper connections between decentralized communities.

On May 8th, we announced a major leap forward for Wilder World: WILD is now live on Solana. Since our inception, we’ve been guided by the principles of decentralization, digital ownership, and open economies. Ethereum provided the foundation for our metaverse, but as we scale, interoperability is key. Expanding to Solana marks the start of Wilder World’s evolution into a fully multi-chain ecosystem.

Why Solana?

The decision to bring WILD to Solana was both strategic and purposeful. Solana is one of the fastest and most scalable blockchains in Web3. Its low fees and efficiency make it a strong fit for trading and accessible to a wide range of users.

Solana’s community is deeply active in NFTs, DeFi, and web3 gaming, which are core pillars of the Wilder ecosystem. By listing WILD on Solana, we are tapping into a thriving user base and injecting new liquidity into the Wilder economy. This expansion does not affect our presence on Ethereum or our partnership with Polygon ZKVM and AggLayer, as well as the roll out of Z Chain. It simply enhances the utility and accessibility of WILD across chains.

Beyond increased visibility, the listing also lays the groundwork for future integration. Solana has one of the most active crypto user bases, particularly in gaming, and NFTs. This opens Wilder World to new audiences, more active trading, and deeper integration with DeFi protocols.

This move supports our broader ecosystem goals. It expands access to WILD, increases interoperability, and positions us to engage more communities across the crypto space.

How to Trade and Add Liquidity

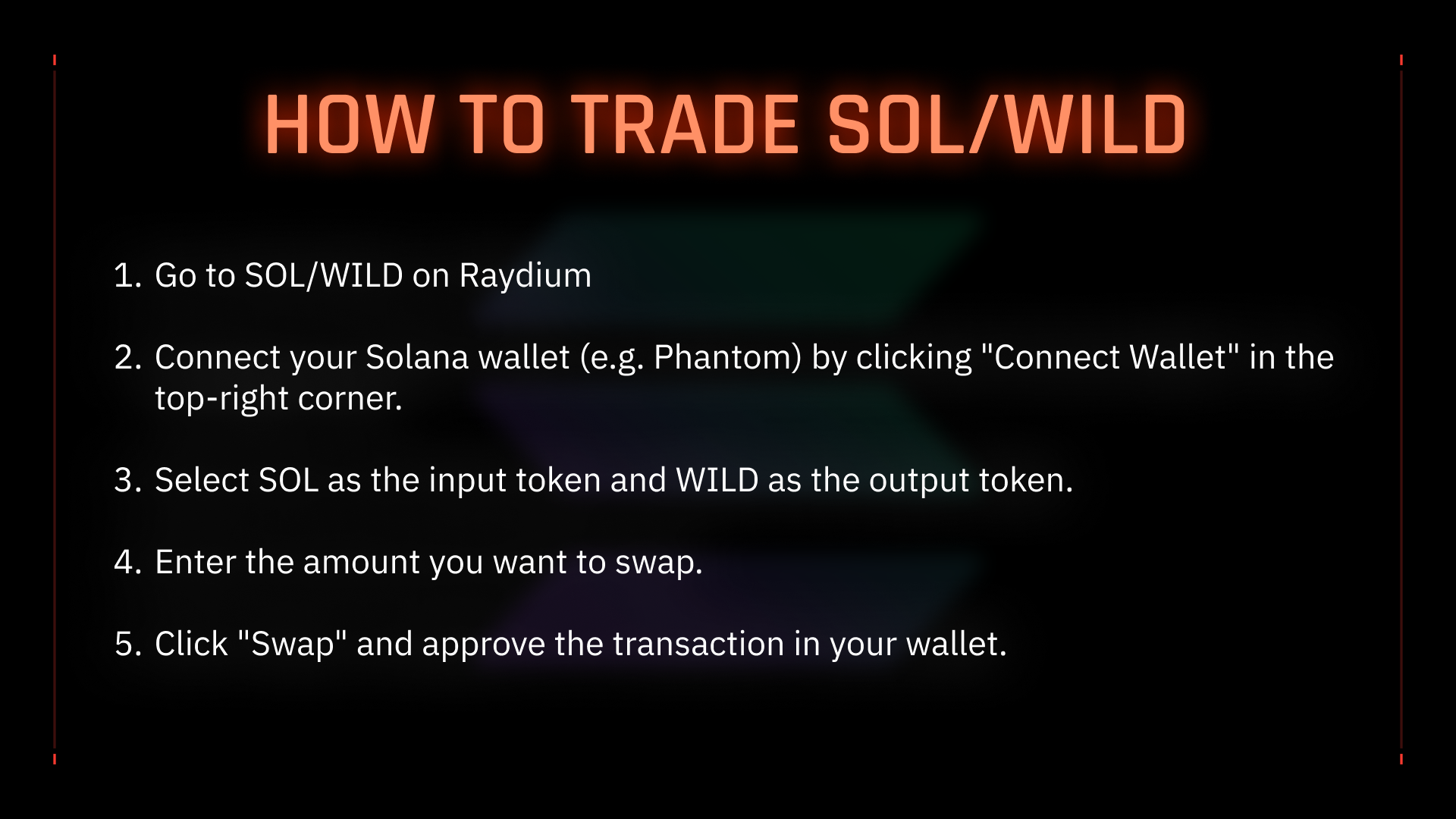

Trading the SOL/WILD Pair

With WILD now live on Solana, users can trade the SOL/WILD pair on Raydium, one of the most popular decentralized exchanges in the Solana ecosystem. Raydium allows users to swap tokens instantly, without needing to register or go through a centralized platform.

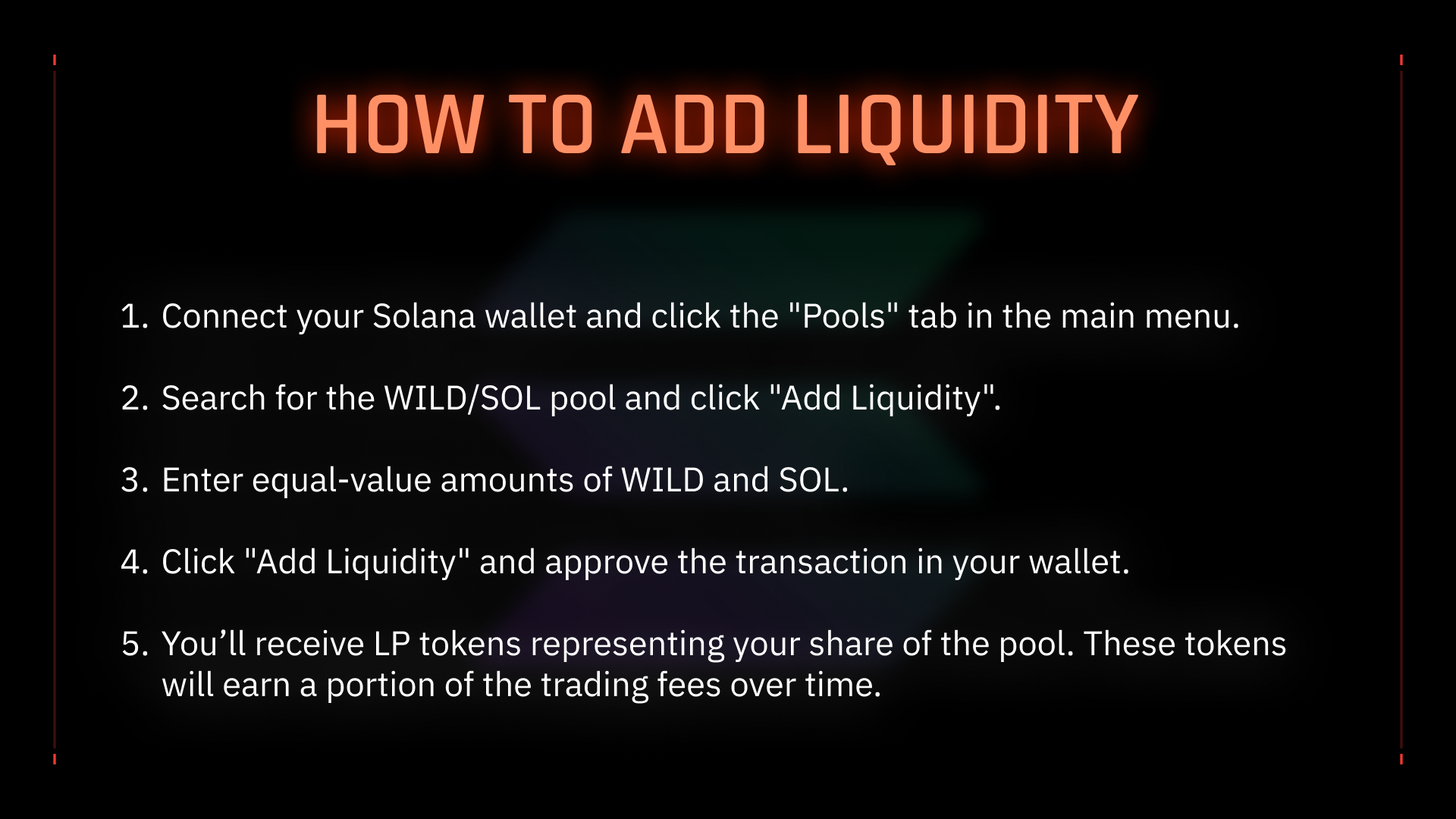

Adding Liquidity to the Raydium SOL/WILD Pool

Wilders can also support token liquidity by contributing to trading pools. This is known as liquidity provision, and it allows participants to earn a share of the fees generated from every trade made in the pool.

By adding an equal value of both tokens to this pool, users receive LP (liquidity provider) tokens in return. These LP tokens represent their share in the pool, and can be used to claim fees proportional to their contribution.

Note: LP tokens on Solana and Ethereum function differently within the Wilder ecosystem.

- Ethereum LP tokens are created by providing WILD and WETH, and can be staked on the Wilder World staking portal to earn WILD rewards (soon to be migrated to Z Chain).

- Solana LP tokens are created by providing WILD and SOL on Raydium, and generate passive rewards through trading fees. They are not staked through Wilder World.

Go-To Resources

- SOL/WILD Trading Pair

- WILD Token Address on Solana

- Add liquidity to the SOL/WILD Liquidity Pool

- Liquidity Pool Address on Solana

- View the Main Dexscreener Liquidity Pool

- Full Guide to Providing Concentrated Liquidity (CLMM)

- Bridge WILD using Wormhole's Portal Bridge

Burning Questions

Q: How does this affect WILD on Z Chain?

A: This will help bring more liquidity to Z Chain when we launch. It doesn’t change our plans to have a fully onchain game via Z Chain.

Q: How does this affect our NFTs?

A: This won’t affect our NFTs.

Q: Is there going to be a bridge for WILD between Ethereum and Solana?

A: Yes, We use LayerZero, which works like this:

- ETH side: Tokens are locked in a contract.

- SOL side: Tokens are minted to the user.

- Return trip: SOL tokens are burned, and ETH tokens are unlocked.

Q: Will there be a way for holders to send WILD crosschain?

A: Yes, you can bridge WILD from Ethereum to Solana and vice versa using the Wormhole app called Portal Bridge.

Q: Why is there one wallet with 66% of the WILD supply on Solana?

A: This is how the crosschain locking and minting mechanism works. This % will go down as more people bridge to Solana.

Q: How does this work for those who might not understand crypto well?

A: There is a single WILD token, which is now available to trade on Solana.

Q: Does this dilute WILD on Ethereum by creating more supply on Solana?

A: No. Any WILD on Solana is locked 1:1 on Ethereum. There are no new tokens being made.

Q: How can there be a new trading pair without increasing the total supply?

A: Any WILD on Solana is locked 1:1 with WILD on Ethereum, so no new tokens are created.

Q: Does the total WILD supply remain fixed?

A: Yes.

Q: Why is there a big difference between the market cap shown on Solana and Ethereum?

A: What is shown on Solana is pulled directly from the Solana blockchain. The FDV reflects only the tokens on Solana.

Q: Some platforms are showing only $11 or $13 of liquidity for WILD on Solana. Will this improve?

A: The main liquidity pool is here on Solana. We are consolidating liquidity there as we scale up trading.

Q: Is there a target WILD supply on Solana? Will it stay fixed or change with demand?

A: Any WILD on Solana is backed by locked tokens on Ethereum. More liquidity can move over, but it will not affect total supply.

Q: How are the market caps on Solana and Ethereum related? Will they impact each other?

A: The market cap is the same across both chains. It will be aggregated across all trading pools. We are working with CoinMarketCap and CoinGecko to ensure this is accurately reflected.

Q: Why are different platforms showing different market caps and supply numbers?

A: Some platforms on Solana are pulling incomplete or delayed data. The best place to track and trade WILD on Solana is the main pool on Dexscreener or on Coin Gecko.

Q: Is there a plan to improve liquidity on Solana? Right now it’s difficult to trade without major slippage, so some clarity on the strategy or timeframe would be helpful.

A: We will continue to improve liquidity on Solana by deepening our integration with top decentralized exchanges like Raydium, strategically seeding key liquidity pools and incentivizing active market participation through future campaigns. As Wilder World expands crosschain, we're committed to building a vibrant, sustainable trading environment on Solana that supports fast execution, minimal slippage, and seamless access to WILD.

Q: I saw that a Pairing/Liquidity Pool had more liquidity when I first bought in, but it suddenly dropped. What happened to the liquidity?

A: It’s important to note that when trading on Raydium, the platform utilizes its routing engine to source liquidity from multiple pools to provide the best execution for your swap. This means that instead of relying on a single liquidity pool, Raydium's smart contracts can route your trade through several pools to find the most favorable rates and minimize slippage. We will be consolidating our liquidity into the 0.25% pool here and the 1% pool here as we establish WILD on Solana.

Conclusion

The launch of WILD on Solana marks a foundational step in Wilder World's crosschain expansion. It increases access, strengthens liquidity, and opens the door to new integrations across Web3. As we continue building toward a fully onchain future with Z Chain, expanding the reach of WILD is key to growing a more open and interoperable ecosystem.

With Blessings,

The Wilders